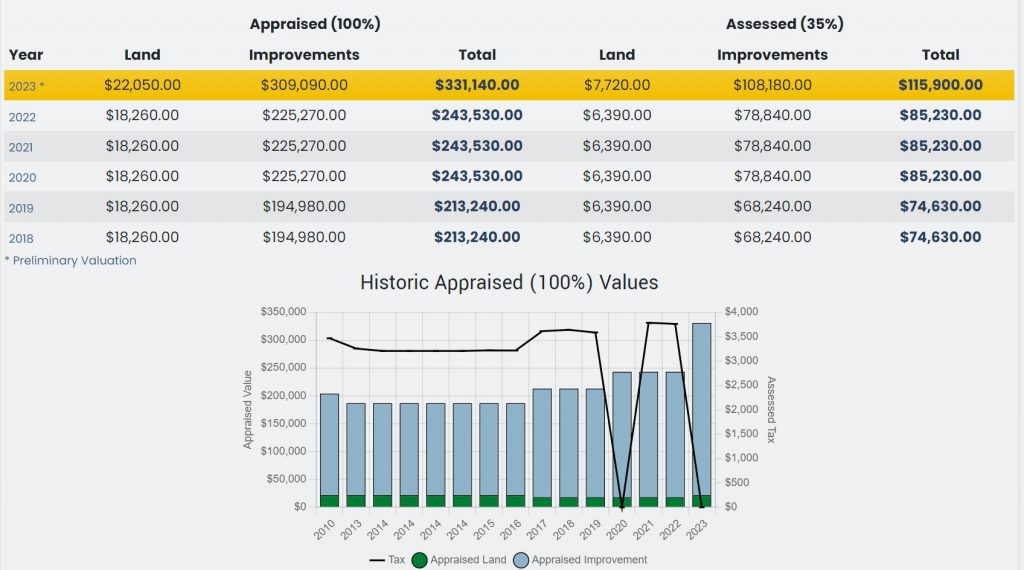

Pickaway – Pickaway County home values are increasing more than 30% from this year’s mass reappraisal and homeowners are wondering how that will affect their taxes. We sat down with Brad Washburn Pickaway County Auditor to get some information.

Ohio Law requires County Auditors to reappraise every property in the County once every six years and to complete a triennial update in the third year of the reappraisal cycle. 2023 is a reappraisal year for Pickaway County. The result of the re-evaluation produced a 34% on average increase in Pickaway

County.

According to Washburn, “The county hires an outside appraisal company, and we contract through those and they have been working on this throughout the entire year. So we physically go to each parcel and will do kind of a visual inspection, maybe take some measurements and whatnot, and then come back, have different databases that compute everything into, and that’s, that’s how that process looks. So throughout this entire year, you’ve probably seen a lot of our vehicles out there with our magnets on the side of them, and you see the little fliers that we leave on your door. That’s our appraisals team that is working. It’s quite an undertaking, each county, has its own timetable, once every six years for this type of undertaking, and once every three years we do a sales update that we don’t go physically inspect the property, but we look at some sales data and compute that.”

The State of Ohio also requires all Ohio Auditors to use uniform procedures to revalue parcels. The auditor looks at recent sales and market trends of similarly situated properties to reach an accurate market value.

“The values are based on the market (sales) and the condition of the property. The appraisal includes assessing the condition of the property and gathering data regarding changes that may have occurred since the last reappraisal. We also consider the size and topography of the land; the age of the structure; the style of the home; square footage; the quality of construction; basement size and finish; outbuildings; as well as the overall condition of the property.”

So why is that important?

“Well, you want to know what the real value of your home is, some people might want to think about selling their home in this type of market. And that’s usually where you start, you usually jump onto the auditor’s website. So it’s very important for us to make sure we have the most accurate data possible in our systems, and take it a step further. A lot of taxpayers are proactive and make sure that they let us know when they do different upgrades to their property throughout that year because we’re not out there every year. So it’s kind of the taxpayer’s responsibility to let us know what changes you made. So we can get that update in our system. So we have the most accurate information. So that’s what we’ve been doing this year, as you can imagine, it’s been pretty, pretty busy here.”

“These are historic valuations that are coming down the line. I mean, you look, Franklin County has already submitted theirs and been approved. 41% Franklin County, just went through their six-year reappraisal, Delaware County, same thing. 35%. And then here, here we are in Pickaway, 34. So we’re all right there.”

“We’ve experienced record growth in the county. I mean, look at everything, all the warehouses, and then what’s going on up in the northern part of the county. And that’s just throughout the entire county has been continually growing, we’re actually right now, still in the process of picking up and establishing values for all the new construction because there’s just so many of them. So that was our priority was to get to the existing homes, and we then kind of finish up with the new construction. So that’s why we’re still out there. You’ll still see our folks that are out there. Picking up the new construction right now.”

What about the taxes on my home?

“What I want to highlight is, that 34% on your value increase does not mean your taxes are going to increase 34%. So I think that’s kind of what people have a mindset of is like, Oh, now my taxes are going to 34% not exactly the case. So the process, there are so many different variables that go into that different levies that we already have established, and that have been voted on by taxpayers have been paying on current levies that are being voted on in November, it’s going to impact that. Also, it’s very important to know that the state of Ohio sends us our tax rates, on the first of December, so we won’t be able to compute what your new tax bill is gonna look like until we get our rates from the state. ”

Millage is equal to one dollar for each $1,000 of taxable valuation. In Ohio, property taxes are assessed on 35% of the appraised value set by the county auditor and are calculated by multiplying the taxable value of a home — that 35% of the appraised market value — times the district’s total millage. So increase in property value will increase your taxes but not at the full value.

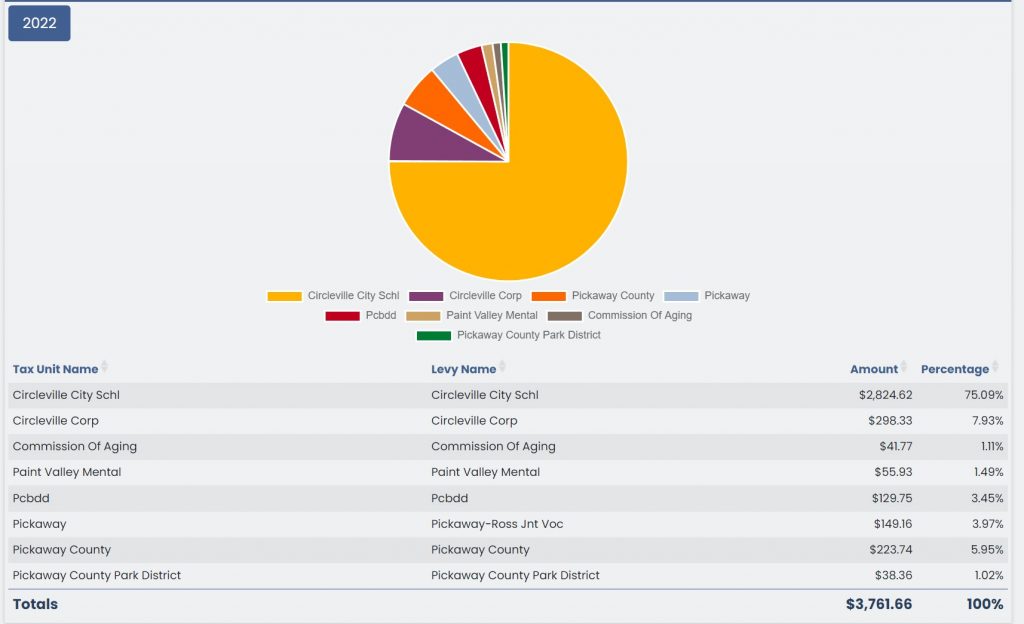

So most likely taxes are going up but that gives Pickaway County a bigger tax base what is that used for?

The bulk of that goes to fund important public services like schools, roads, police departments, fire and emergency medical services, and other services associated with residency or property ownership.

What if I do not agree with my evaluation or if I’m eligible for a reduction?

“So if you go to our website, we have different applications with owner-occupied tax reductions, and you’ll find that form on our website, as well as an application for some exemptions. So there are programs in place, and you can go to our website and look at the different forms and see if any of those apply to you to your situation. And always, we’re here. Always tell people to please feel free to call us that’s what we’re here for. We’re here to serve the people of Pickaway County, we can help navigate people and we can answer any questions. Just want to call the office. We’re open from eight to four Monday – Friday.

You can check out the Auditor’s Website here: https://auditor.pickawaycountyohio.gov/ the site will also give you election info on current levies that are on the next election.